do you have to pay taxes on inheritance in michigan

After much uncertainty Congress stabilized the Federal Estate Tax also known as the death tax. How much or if youll pay depends upon where the annuity came from and how much its worth.

Estate Lawyer In Michigan 30 Years Experience

Its applied to an estate if the deceased passed on or before Sept.

. The beneficiary who receives the inheritance has to pay the tax. The income tax return filed after the deadline is called belated ITR. Its applied to an estate if the deceased passed on or before Sept.

There is no federal inheritance tax. Send Treasury a letter within 90 days of discovering the asset. How much or if youll pay depends upon where the annuity came from and how much its worth.

There are some cases such as those with newly discovered assets in which you may have to address the tax. Also at tax time will I have to pay additional taxes to Michigan for the inheritance. An inheritance tax is a tool that governments sometimes use to tax assets that people get as part of an inheritance.

Spouses are exempt from inheritance taxation while children can be exempt or pay a minimal amount. As of 2021 you can inherit up to 1170000000 tax free. You need to specify which taxes you are concerned about.

States that collect an inheritance tax as of 2020 are Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. Married people get to double the exemption. What amount of taxes will be deducted.

This is because it only applies to assets of people who passed away on or before September 30 1993. Thats because federal law. Estate tax and failed to pay prior to distribution to the heirs other foreign governments.

The last date to file income tax return for FY 2021-22 AY 2022-23 was July 31 2022. You will pay 000 in taxes on the first 1170000000. If you have a new job you can figure out what your take home pay will be using our Michigan paycheck calculator.

The first rule is simple. According to the Michigan Department of Treasury if a beneficiary inherits assets from a loved one who died after 1993 they do not need to pay inheritance tax to the state of Michigan. I now need a determination of inheritance tax in order to close the estate.

However while you may not have to pay capital gains or income taxes on the inheritance from a trust there are still other taxes and fees you may have to pay especially if you inherit an asset itself rather than a share of the money earned from its sale. What do I need to do. The tax in these states ranges from 0 to 18.

No estate tax or inheritance tax. Michigan does not have an inheritance tax. Anything over that amount is taxed at 40.

For example if you inherit a traditional IRA or a 401k youll have to include all. We will be opting for the lump sum payment I believe the total was 30000. Michigan Taxes on Annuities.

As mentioned on the official state website you would probably not have to worry about Michigans inheritance tax. I have just re-opened an estate at the probate court due to an After Discovered Asset. If you indicate which state you are resident of i can confirm whether you have an inheritance tax issue.

However an individual can file ITR even if this deadline of filing ITR is missed. The sales tax rate across the state is 6. Generally when you inherit money it is tax-free to you as a beneficiary.

I will be splitting it with my sisters. 15 best ways to avoid inheritance tax in 2020. The average effective property tax rate in Michigan is 145.

You do not pay inheritance tax on a surviving. Inheritances that fall below these exemption amounts arent subject to the tax. Michigan does not have an inheritance tax with one notable exception.

State Income Taxes and Federal Income Taxes. Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less. One will have to pay a late filing fee when filing a belated ITR.

You may think that Michigan doesnt have an inheritance tax. Although there is no federal tax on it inheritance is taxable in 6 states within the US. You wont have to report your inheritance on your state or federal income tax return because an inheritance is not considered taxable income but the type of property you inherit might come with some built-in income tax consequences.

In limited instances the US. Do beneficiaries have to pay taxes on inheritance. Include the date of discovery type of asset s date of death value if an asset is real.

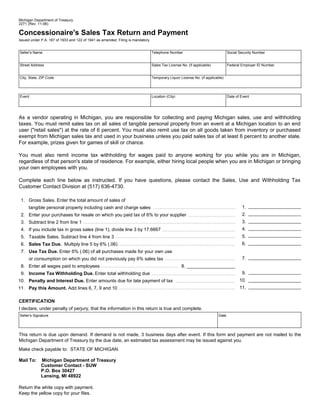

Although Michigan does not impose a separate inheritance or estate ta x on heirs you may have to pay state taxes on your annuity income. Does not have an inheritance taxThus any inheritance you receive as a beneficiary is federally inheritance tax-free to you assuming relevant estate taxes have been paid. As you can imagine this tax can have a big impact when leaving a significant estate to your heirs.

Federal Death Tax. Each has its own laws dictating who is exempt from the tax who will have to pay it and how much theyll have to pay. Michigans income tax rate is a flat 425 and local income taxes range from 0 to 24.

Both federal and state. How do you avoid inheritance tax. According to DGKT Accountants here are the three tiers for the most recent.

Mom had opted to have federal taxes withheld at 10 but not have Michigan state tax withheld. You have to report the sale if you did not own and live in the home for 2 of the 5 years immediately preceding the sale. Michigan does not have an inheritance tax with one notable exception.

If you receive property in an inheritance you wont owe any federal tax. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000. The best way to understand these risks and understand how the inheritance process.

The Michigan inheritance tax was eliminated in 1993. Technically speaking however the inheritance tax in Michigan. Government may attach beneficiary inheritances where the estate were subject to US.

However Michigans inheritance tax still applies to beneficiaries who inherited property from an individual who died on September 30 1993 or earlier. You might inherit 100000 but you would pay an inheritance tax on just 50000 if the state only imposes the tax on inheritances over 50000.

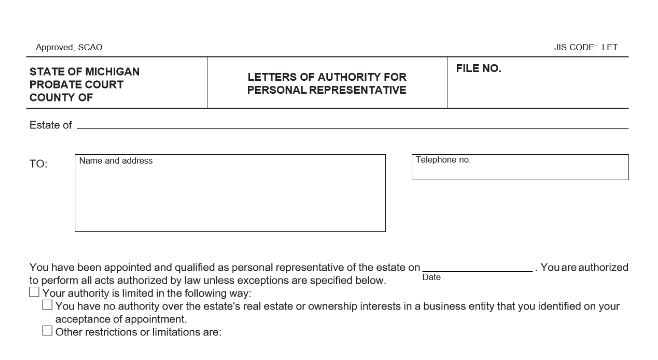

Michigan Probate Attorney Atlas Law

Mi 1040cr 2booklet Michigan Gov Documents Taxes

Annuity Taxation How Various Annuities Are Taxed

Michigan Probate Laws Steps In The Probate Process Explained

Inheritance Tax Checklist Know Before You Sell Sensible Money

Everything You Need To Know About Michigan State Taxes Yaktrinews Com

Michigan Probate Laws Steps In The Probate Process Explained

Petition For Probate And Appointment Of Personal Representative The Probate Pro

Petition To Allow Account The Probate Pro

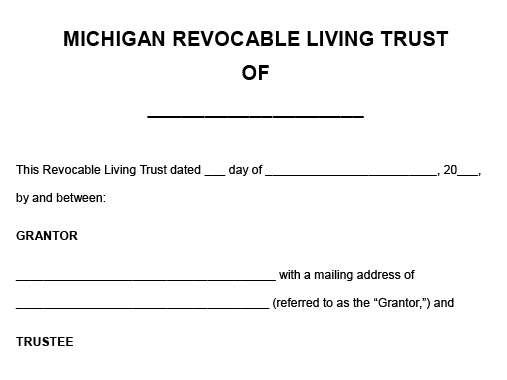

Michigan Personal Representative And Trustee Duties When Siblings Can T Agree How To Jointly Administer An Estate Or Trust