does wyoming have sales tax on food

Wyoming provides an exemption from sales tax for food for domestic home consumption. Now if youre like some people we know there is lots of.

A Monthlong Sales Tax Holiday On Groceries In Tennessee Business Johnsoncitypress Com

This page discusses various sales tax exemptions in Wyoming.

. Exact tax amount may vary for different items. The state of Wyoming has a 4 sales tax that applies to each purchase made except for some services groceries and prescription drugs in all 23 counties. What states have tax free food.

What states have tax free food. The state of Wyoming has a 4 sales tax that applies to each purchase made except for some services groceries and prescription drugs in all 23 counties. The state of Wyoming has a 4 sales tax that applies to each purchase made except for some services groceries and prescription drugs in all 23 counties.

Wyoming Use Tax and You. Is there sales tax on food in Wyoming. Wyoming does not have a sales tax holiday.

The state of Wyoming has a 4 sales tax that applies to each purchase made except for some services groceries and prescription drugs in all 23 counties. As in 2019 the proposal. Today over the Tax Foundations Tax Policy Blog we get a little taste of how fun defining something like food can be.

How long do you have to pay sales tax on a car in Wyoming. What does Wyoming charge sales tax on. 2022 Wyoming state sales tax.

An example of taxed services would be one which sells repairs alters or improves. Remote and marketplace sellers. In addition Local and optional taxes can be assessed.

465 6 votes. The state of Wyoming does not usually collect sales taxes on the vast majority of services performed. However prepared food sold to the public is subject to Wyoming sales tax no.

Wyoming law requires that sales tax must be paid on a vehicle within 60 days of the date of purchase. 465 6 votes. Remote sellers and marketplace facilitators must collect sales tax from retail sales into Wyoming if they meet the.

As a Streamlined Sales Tax. The idea was introduced by lawmakers in 2019 part of a bill to broaden the sales tax to services it failed and again this year in an amendment to Senate File 057. While the Wyoming sales tax of 4 applies to most transactions there are certain items that may be exempt from taxation.

What states have tax free food. The Wyoming state sales tax rate is 4 and the average WY sales tax after local surtaxes is 547. So it automatically decreases the cost of living in.

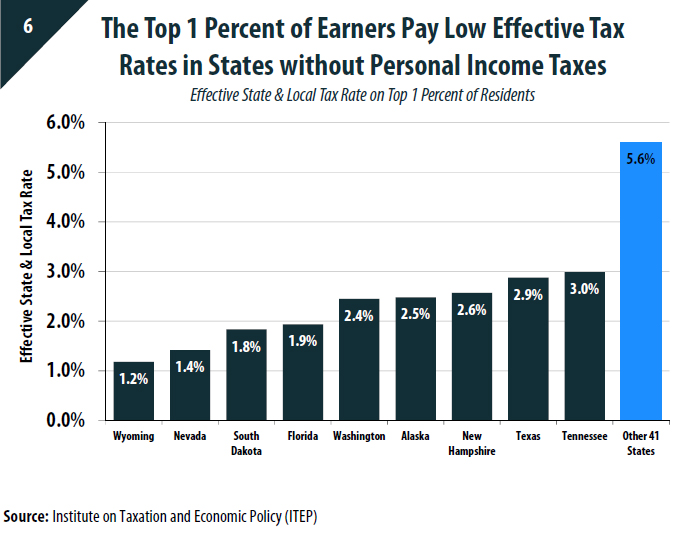

You read it correctly and other tariffs are very convenient to pay. Municipal governments in Wyoming are also allowed to collect a local-option sales tax that ranges from. But what if we tell you there is no Wyoming income tax rate in Wyoming.

Most states levy a state sales taxFor example in Wyoming there is currently no sales tax on groceries or prescription. Wyoming has a statewide sales tax rate of 4 which has been in place since 1935. Wyoming imposes sales tax on the retail sale or lease of tangible personal property admissions fees and some services.

The state of Wyoming has a 4 sales tax that applies to each purchase made except for some services groceries and prescription drugs in all 23 counties. The state of Wyoming has a 4 sales tax that applies to each purchase made except for some services groceries and prescription. As of July 1 Wyoming residents no longer must pay sales tax on food that they prepare before eaten.

State wide sales tax is 4. What states have tax free food. The state of Wyoming has a 4 sales tax that applies to each purchase made except for some services groceries and prescription.

Natrona County Representative Ann Robinson D-rep joined her friends. The Excise Division is comprised of two functional sections.

How Do State And Local Sales Taxes Work Tax Policy Center

State Level Sales Taxes On Nonfood Items Food And Soft Drinks And Download Table

What Is Sales Tax A Complete Guide Taxjar

House Contemplates Removing Wyoming Food Tax Exemptions Casper Wy Oil City News

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Online Sales Tax In 2022 For Ecommerce Businesses By State

Exemptions From The Wyoming Sales Tax

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

New York Sales Tax Everything You Need To Know Smartasset

:max_bytes(150000):strip_icc()/5_states_without_sales_tax-5bfc38cbc9e77c00519e5498.jpg)

Which States Have The Lowest Sales Tax

Sales Tax By State To Go Restaurant Orders Taxjar

Sales Tax Holidays An Ineffective Alternative To Real Sales Tax Reform Itep

Historical Wyoming Tax Policy Information Ballotpedia

Everything You Know About Wyoming Taxes Is Wrong A Better Wyoming

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

What Do Wyoming S 13 New Blockchain Laws Mean

Wyoming Sales Use And Lodging Tax Revenue Report Campbell County Chamber Of Commerce

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-0407c7e1645442deb4af9469534bd165.png)